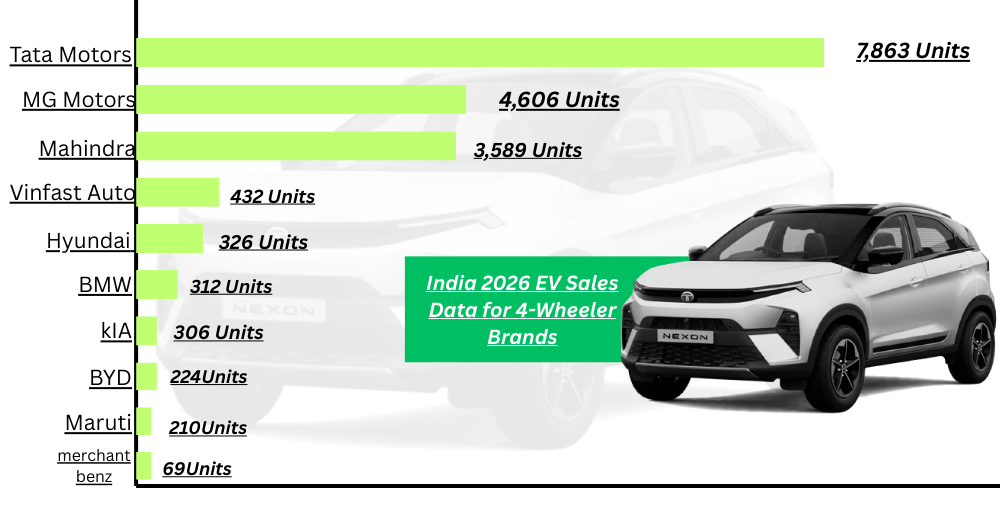

India 2026 EV Sales Data for 4-Wheeler Brands

DETAILS

January 2026 EV Sales Data – 4-Wheeler Brands in India

| Tata Motors | 4,606 Units |

| Mahindra | 3,589 Units |

| VinFast Auto | 432 Units |

| Hyundai | 326 Units |

| BMW | 312 Units |

| Kia | 306 Units |

| BYD | 224 Units |

| Maruti | 210 Units |

| Mercedes-Benz | 69 Units |

Tata Motors Leads the EV Market in 2026

- Wide EV portfolio (Tiago EV, Punch EV, Nexon EV, etc.)

- Strong dealership network across India

- Competitive pricing

- First-mover advantage in the mass EV segment

- High consumer trust in the brand

MG Motors Secures the Second Position

Mahindra Strengthens Its EV Presence

Emerging and Premium EV Brands in India

What the 2026 EV Sales Data Reveals

- Proven EV experience

- Strong service networks

- Competitive pricing

- Clear EV strategy

Why EV Sales Are Rising in India in 2026

- Rising petrol and diesel prices

- Increasing environmental awareness

- Lower running cost of EVs

- Government incentives and state subsidies

- Expanding charging infrastructure

- More affordable battery technology

EV Market Outlook for the Rest of 2026

- Stronger competition among the top three brands

- More EV SUV launches

- Improved charging networks in Tier-2 and Tier-3 cities

- Higher EV penetration in urban India

- Gradual shift from early adopters to mainstream buyers

Latest News

Latest cars

Rs.60.00 Lakh - 70.00 Lakh

Rs.6 Lakh - 10.50 Lakh

Rs.9 Lakh - 10 Lakh

Rs.19.95 Lakh - 29.95 Lakh

Rs.11.49 Lakh - 20.49 Lakh

Upcoming cars

Rs.27.00 Lakh - 27.00 Lakh

Rs.20 Lakh - 25 Lakh

.jpg)

Rs.25 Lakh - 25 Lakh

Rs.40 Lakh - 50.13 Lakh

Rs.60.00 Lakh - 65.00 Lakh

More Related News

.png)

Huge Discounts on Cars in 2026: Save from INR 30K to INR 1 Lakh+ on Top Models

The Indian automobile market in 2026 is shaping up to be a buyer’s market. With manufacturers pushing sales through aggressive pricing strategies, car buyers now have access to huge discounts ranging from INR 30K to well over INR 1 lakh on some of the most popular and premium cars in India. From luxury SUVs to rugged off-roaders and family-friendly vehicles, brands like Toyota, Hyundai, Tata, and Mahindra are offering attractive deals that make this one of the best times to buy a new car. These offers are a mix of cash discounts, exchange bonuses, and dealer-level benefits, depending on the model and location. If you’ve been waiting for the right moment to upgrade or invest in a premium vehicle, 2026 could be your year.

Read More

Meet the Hyundai Inster – A Small Electric Car With Big Surprises

Electric cars are no longer just about being eco-friendly. Buyers today want style, practicality, range, and features that actually make daily driving easier. Hyundai seems to understand this shift very well, and the Hyundai Inster is proof of that. At first glance, the Inster looks like a compact city EV. But spend a little time with it, and you realize it offers far more than its size suggests. From clever interior space to impressive electric range, the Hyundai Inster is designed for modern urban drivers who want an affordable and capable electric vehicle without compromise. Let’s take a closer look at what makes the Hyundai Inster a small electric car with genuinely big surprises.

Read More (1).png)

India-EU FTA Boosts Luxury Car Market with Major Import Duty Cuts

India has taken a bold step to open its premium automobile market to European luxury carmakers. Under the newly concluded India-EU Free Trade Agreement (FTA), the country will immediately slash import duties on high-end European cars from a staggering 110% to 30%, marking one of the most significant policy shifts in India’s luxury car segment. This move is expected to benefit global brands such as BMW, Mercedes-Benz, Audi, Porsche, Ferrari, Lamborghini, and Volvo, while still safeguarding domestic players in the EV and mass-market segments.

Read More

JSW Motors to Enter Indian Passenger Car Market With New SUV

The Indian passenger car market is set to welcome a new player. JSW Group, one of India’s largest and most diversified conglomerates, is preparing to enter the car segment under a new brand called JSW Motors. According to recent reports, the company plans to launch its first SUV before Diwali 2026, marking its official debut as a car manufacturer in India. This move comes after years of involvement in the automotive supply chain and strategic partnerships, including the well-known JSW–MG Motor India joint venture. With SUVs continuing to dominate Indian car sales, JSW’s entry could add serious competition in the mid-size and premium SUV space. Going forward in this articles below down we will highlight the journey of JSW group & how they plan to enter Indian passenger vehicle industry. Their thoughts, strategy, plan & execution and most importantly their choice to disrupt Indian automobile sector with launch of their first vehicle and that too of SUV vehicle. We will highlight the launch timeline, expected price, platform details, powertrain options, and what it means for the Indian auto market.

Read More

Indian Consumers Are Choosing Homegrown Brands in Record Numbers

The Indian automobile industry is no longer playing catch-up with global giants—it is setting the pace. Over the last few years, especially post-2023, Indian-origin automobile brands have entered a phase of unprecedented growth, innovation, and consumer trust. There is 70,000 bookings for Tata Sierra in a single day and 93,000 bookings for Mahindra 7X0 in just four hours. This surge in bookings clearly signals one thing: Indian consumers now believe in Indian brands more than ever before. What we are witnessing today is the golden phase of Indian automobiles, driven by bold design choices, global-level safety standards, advanced technology, and a deep emotional connection with buyers.

Read More

Neck to Neck Brand Value Comparison Maruti Suzuki and Tata Motors

The Indian passenger vehicle market is one of the most competitive in the world, and two names consistently dominate conversations around trust, scale, and growth: Maruti Suzuki and Tata Motors. While both brands manufacture cars for Indian consumers, their approach to business, pricing, customer targeting, and brand value is fundamentally different. This detailed comparison explains how Maruti Suzuki has built unmatched market dominance and why Tata Motors is slowly reshaping its brand toward premium aspirations, based on FY25 passenger vehicle data.

Read MoreSubscribe Now

Want to Know more about Upcoming and New

Cars… Ask Us!